When people hear the phrase “futures trading,” they often think of Wall Street, financial markets, and high-level strategies that require deep analysis. At its core, however, futures trading shares a fascinating resemblance with casino gaming. Both involve taking calculated risks, studying probabilities, and making decisions under uncertainty. While futures markets are tools for hedging and investment, the psychology behind them often parallels the thrill of playing at the casino tables. For players and traders alike, the challenge is learning to manage risks and rewards with discipline and foresight. Platforms such as Futures trading make it easier than ever to access these opportunities, merging finance with cutting-edge technology.

What Is Futures Trading?

Futures trading is the practice of buying or selling a financial contract that locks in the price of an asset for delivery at a future date. These assets can include commodities, stocks, or cryptocurrencies such as Bitcoin. Unlike spot trading, where assets are exchanged immediately, futures allow traders to speculate on price movement without owning the underlying asset. This makes futures a powerful tool not only for speculation but also for hedging against market volatility.

The Casino Parallel

At first glance, casino gaming and futures trading may seem worlds apart. Yet, they share common principles:

- Risk and Reward: Both require players to weigh potential gains against possible losses.

- Probability: Casino games like blackjack or roulette involve odds, much like analyzing market trends.

- Discipline: Just as a professional gambler sets betting limits, a successful trader uses stop-loss orders and risk management strategies.

- Psychology: Emotions can cloud judgment in both casinos and markets, making self-control crucial.

Technology Driving Both Worlds

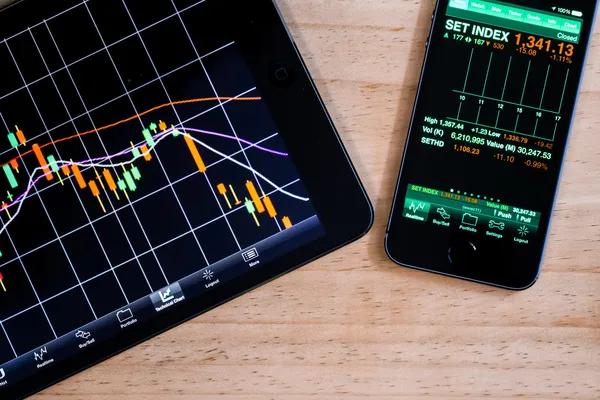

Modern casinos thrive on digital platforms, offering online slots, poker, and live dealer games accessible from mobile devices. Futures markets have followed the same path. With advanced trading apps and exchanges, anyone can participate in global markets from the comfort of their home. High-speed internet, real-time data, and secure transactions have made both online casinos and trading platforms more accessible and appealing than ever before.

Comparison: Futures Trading vs. Casino Gaming

| Aspect | Futures Trading | Casino Gaming |

|---|---|---|

| Core Purpose | Investment, speculation, risk hedging | Entertainment, chance-based winnings |

| Skill vs. Luck | Requires analysis, strategy, and risk management | Some games (poker, blackjack) require skill; others (slots, roulette) depend largely on luck |

| Accessibility | Trading apps and exchanges worldwide | Online casinos and physical venues |

| Regulation | Heavily regulated financial markets | Regulated by gaming authorities, varies by region |

| Potential Reward | Profit from market movements | Winning money, bonuses, or prizes |

Risk Management Lessons from Casinos

One of the most valuable lessons casinos teach is the importance of managing limits. Casinos thrive because most players gamble without structured strategies. Successful futures traders avoid that mistake by sticking to predetermined plans, using stop-loss orders, and never risking more capital than they can afford to lose. This alignment of discipline highlights the thin line between entertainment and investment.

Final Thoughts

Futures trading and casino gaming share a fascinating connection rooted in risk, strategy, and human psychology. Both offer opportunities for reward but demand responsibility and discipline. By understanding the similarities and differences, enthusiasts of either world can gain valuable insights into decision-making under uncertainty. Whether you are rolling the dice at a roulette table or analyzing Bitcoin contracts on a trading platform, the ultimate goal remains the same: finding the balance between risk and reward in pursuit of success.